Little Known Facts About Esg.

Wiki Article

The Greatest Guide To Esg Strategy

Table of Contents6 Simple Techniques For Esg TechnologyGet This Report about Esg SustainabilityThe Single Strategy To Use For Esg InvestingEsg Technology for Beginners

Why do specific financial investments carry out better than others? Why do specific startups seem to always exceed as well as obtain ahead of the mate? The answer has 3 letters, as well as it is Whether you are a capitalist or a firm, huge or tiny - Environmental, Social and also Governance (ESG) reporting as well as investing, is the framework to capture on if you intend to stay up to speed with the market (as well as your costs) - ESG Sustainability.Now, allow's study the ESG subject and the fantastic significance that it has for firms as well as capitalists. To aid financiers, banks, and firms comprehend much better the underlying requirements to carry out and report on them, we designed a. Download and install the type listed below as well as gain access to this exclusive ESG source free of cost.

The practice of ESG investing began in the 1960s. ESG investing evolved from socially liable investing (SRI), which excluded supplies or entire markets from investments related to service operations such as cigarette, weapons, or items from conflicted areas.

Components of it are efficient from March 2021. The objective is to reorient capital circulations towards sustainable financial investment and also away from markets contributing to environment adjustment, such as fossil fuels.: is probably the most enthusiastic text aiming to provide a non-financial general rating covering all elements of sustainability, from ESG to biodiversity as well as contamination treatment.

Unknown Facts About Esg Strategy

So you instead get on this train if you do not want to be left behind. There is a boosting recognition that. For business to remain ahead of policies, competition and release all the advantages of ESG, they must integrate this framework at the core of their DNA. In another point of view, to handle regulative, lawful or reputation issues at a later phase.

(ESG) concerns are playing an increasing duty in firms' choices around mergers, purchases, as well as divestitures. Exactly how do these factors connect to company efficiency and deal prospective? They spoke with Technique & Corporate Financing interactions director Sean Brown at the European 2020 M&A Conference in London, which was organized by Mc, Kinsey and also Goldman Sachs.

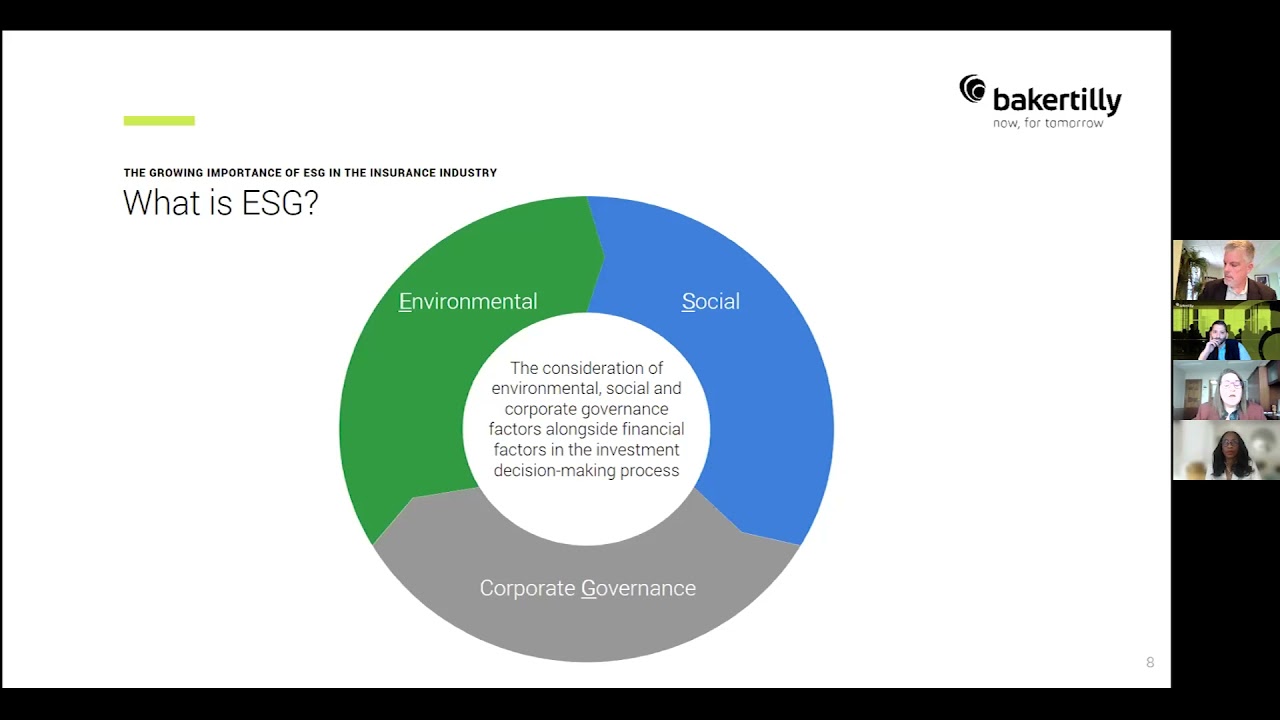

Audio Why ESG is below to stay Sara, could you start by clarifying what ESG is as well as why it has risen in significance in M&A? ESG is rather a broad collection of issues, from the carbon dioxide impact to labor techniques to corruption.

The Esg Strategy Diaries

Why are those 3 issues grouped with each other when they are so substantially different? They link with each other in the sense that the environment, the social elements, and the extent to which you have excellent administration impact your certificate to operate as a business within the external world. To what level do you handle your environmental impact? To what degree do you enhance diversity? To what extent are you clear site here in your payments to a country? That has an influence on your license to operate psychological of the stakeholders around you: regulators, governments, and significantly, NGOs powered by social networks.Customers are currently requiring high requirements of sustainability as well as high quality of work from companies. Regulators and also plan makers are more thinking about ESG since they need the business sector to help them view fix social troubles such as ecological contamination as well as work environment variety (ESG Investing). The financier area has actually additionally come to be a lot more interested.

So, taking an industry-by-industry lens is critical as well as we currently see ESG-scoring firms constructing deeper industry-specific perspectives. What are several of the crucial elements on which ESG scores have an impact? The first inquiry you require to answer is, to what degree does good ESG convert into excellent monetary efficiency? On that particular, there have actually been greater than 2,000 scholastic studies and also around 70 percent of them find a favorable partnership in between ESG ratings on the one hand as well as financial returns on the other, whether determined by equity returns or success or assessment multiples.

The Ultimate Guide To Esg Investing

Evidence is emerging that a better ESG score converts to regarding a 10 percent lower price of funding as the threats that influence your company, in terms of its certificate to operate, are minimized if you have a strong ESG recommendation. Proof is arising that a much look at this site better ESG rating equates to about a 10 percent lower cost of funding, as the dangers that affect your service are decreased.Report this wiki page